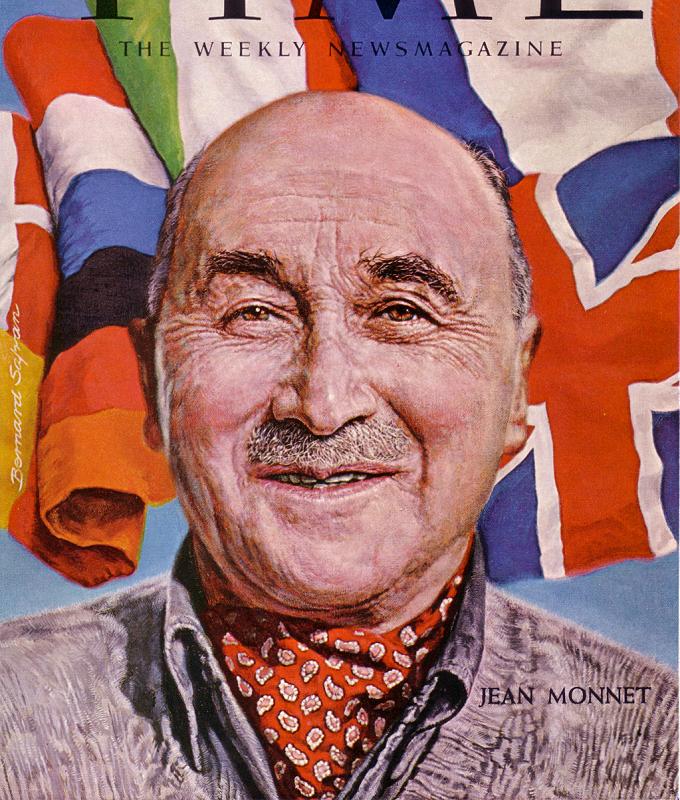

Manifesto of Jean Monnet Chairs: Stabilizing the Euro Area and the EU

30 janvier 2012

The undersigned holders of Jean Monnet Chairs wish to express our confidence in the overall strength of the Euro Area while at the same time calling for improved EU crisis management and stabilization policy. It should be emphasized that:

The undersigned holders of Jean Monnet Chairs wish to express our confidence in the overall strength of the Euro Area while at the same time calling for improved EU crisis management and stabilization policy. It should be emphasized that:

1) The first Euro integration decade has been quite successful in terms of a low inflation rate and considerable economic welfare gains. This is the benchmark for a successful monetary union.

2) The Euro Area as whole continues to exhibit a strong economic profile with a debt to GDP ratio of 85%, a household debt-to-income ratio of 107%, a budget deficit of 6.6% and continuing economic growth of 1.6% in 2011. While the outlook for 2012 is challenging, these statistics compare favorably with the US, Japan and the UK, all of which have higher household debt-to-income ratios, larger budget deficits (of the order of 10%), lower growth in 2011, and with the exception of the UK (79%) debt to GDP ratios in excess of 100%. The relative strength of the Euro thus needs to be seen in perspective.

3) Nevertheless, despite the strength of the Euro Area as a whole, macroeconomic imbalances across a minority of Euro Area countries have grown dramatically without being subject to proper discipline by the markets or timely intervention by the European Commission.

4) Ultimately, it is the responsibility of purchasers of bonds issued by both governments and financial institutions to exercise due diligence in monitoring the financial health of those to whom they are lending. Nevertheless the failure of financial markets to exercise this discipline may subsequently have contagion effects on other member states and thus there is a crucial role to be played by the European Commission in holding member governments to account for their budgetary policies and overall financial position.

5) In the future stricter and more consistent surveillance is needed and those Euro member countries which depart from their statutory duties, such as incurring in excessive imbalances, should be expected to report publicly to the European Commission or an independent council.

6) In the first decade of the Euro Area the European Commission has failed to adequately defend the rules of the Euro Area aimed at the protection of Euro Area countries. E.g. the consistently high debt to GDP ratio in Italy and the extreme budget deficit to GDP ratio of more than 15% in 2009 in Greece and its consistent poor debt to GDP ratio are 2 cases that would have justified the intervention of an independent inspection panel in the countries concerned. No community and no integration club can live without respect to the rule of law. But even monitoring breaches of the original Maastricht Criteria is insufficient. Ireland was ostensibly in surplus for much of the last decade but its buoyant economy, and in particular its housing market and tax base, owed much to inappropriate external financing of Irish banks. These were matters which should have concerned the European Commission long before Ireland’s emergency 32% current budget deficit in 2010.

7) The European Council took an extreme, yet controversial, decision when it voted in favor of a 21% haircut for private creditors of Greece in July and 50% in October, 2011. If we are to avoid moral hazard problems in lending decisions, banks must appreciate that the EU will not bail them out if they continue to finance inappropriate levels of historical debt or budget deficits to individual member states. However there is a balance to be struck by the Commission in maintaining the confidence of financial markets and washing its hands of poor budgetary processes by member states. It is undisputed that haircuts can undermine confidence in the financial products of the Euro Area. Hence haircuts should be a last resort. Alternatives such as privatization of State assets offer a clear and more promising strategy aimed at supporting countries with debt refinancing problems.

8) But privatization can only be a medium-term measure. It is imperative that the political institutions and the policy makers, respectively, consider the options for stabilizing the budgets of those parts of the Euro Area which continue to maintain unbalanced budgets. In particular, in the absence of the (damaging) ability of individual national governments to inflate away their as they might have in the past, there needs to be a systematic rebalancing of the tax gathering capacity and level of government spending within nation states. This is a pre-requisite of any well-functioning state within a monetary union, whether or not we move towards Fiscal Union or a full Political Union in the long run.

9) The recent consultation launched by the European Commission on the feasibility of Stability Bonds is an important option. The many options envisaged include the full substitution of Stability Bond issuance for national issuance under a joint and several guarantees, a partial substitution of Stability Bond issuance for national issuance under similar guarantees and a partial substitution of Stability Bond issuance for national issuance under several guarantees. These options present different trade-offs between the expected benefits and pre-conditions to be met. They represent various methods of providing appropriate short-term financing options for nations which are fundamentally fiscally sound (given the stage of the business cycle) but are being dragged into the current crisis due to contagion effects. They do not absolve fiscally imprudent states from taking appropriate remedial action or European political leaders for ensuring these actions happen. In any event, there should be a new Stability Pact with automatic sanctions for excessive debts and deficits but it should also include surplus requirements in booms.

10) The Euro project deserves more institutional design and less improvisation. The ECB needs to be more flexible in terms of its stabilization role in the euro area; it could buy national € bonds, but it could also place ECB € bonds in the market. Reform actions taken must be faster; debt brakes (e.g. golden rules) should be in national constitutions. The EU/Euro Area faces today a global responsibility in avoiding a crisis of global scale.

The initiators of this Manifesto are:

Prof. Dr. Alberto Alemanno, HEC, Paris

Prof. Dr. Sylvester Eijffinger, University of Tilburg

Prof. Dr. Cillian Ryan, European Research Institute, University of Birmingham

Prof. Dr. Paul JJ Welfens, European Institute for International Economic Relations at the University of Wuppertal

Aucun commentaire.